A recent and intriguing advancement in the cryptocurrency industry is the creation of algorithmic stablecoins. Even in times of market instability, the prices of these digital assets will remain constant. We shall examine the workings, advantages, and drawbacks of algorithmic stablecoins in this article.

This article’s goal is to give a thorough review of algorithmic stablecoins, covering their workings, advantages, and drawbacks. The fundamental ideas behind these digital assets, such as seigniorage shares, collateralization, and rebasing, will be covered in detail. Additionally, we’ll look at actual use cases for algorithmic stablecoins like Ampleforth, Basis Cash, and Empty Set Dollar.

We will talk about algorithmic stablecoins’ possible hazards, restrictions, and issues throughout the article. These include the possibility for market manipulation, sensitivity to market fluctuations, and reliance on the security of the cryptocurrency ecosystem at large. Additionally, we will explore regulatory concerns and difficulties while contrasting algorithmic stablecoins with conventional stablecoins.

Readers may anticipate having a complete grasp of algorithmic stablecoins, including their advantages, hazards, and potential applications, by the conclusion of this study. We want to be a helpful resource for anybody looking to learn more about this fascinating advancement in the crypto industry.

Contents

Mechanisms of Algorithmic Stablecoins

Cryptocurrencies known as algorithmic stablecoins utilize algorithms to keep their prices stable. They do this by utilizing a variety of mechanisms, including rebasing, collateralization, and seigniorage shares.

Seigniorage shares are one of the most often employed techniques in algorithmic stablecoins. Tokens known as seigniorage shares represent a portion of the algorithmic stablecoin’s seigniorage earnings. The algorithmic stablecoin issues more seigniorage shares when the price of the stablecoin rises, and it purchases seigniorage shares when the price falls. This aids in maintaining the stablecoin’s price.

Ampleforth (AMPL) is one illustration of an algorithmic stablecoin that makes use of seigniorage shares. To keep prices stable, AMPL employs an elastic supply policy. The algorithmic stablecoin produces additional tokens when the price of AMPL rises beyond a specific level and purchases tokens when the price drops.

Collateralization is another method that algorithmic stablecoins employ. Utilizing a collateral asset to support the stablecoin is known as collateralization. To keep prices stable, the value of the collateral asset is utilized. The algorithmic stablecoin releases additional tokens when the stablecoin’s price increases and it burns tokens when the price decreases.

Basis Cash (BAC), an algorithmic stablecoin that makes use of collateralization, is one such example. Cryptocurrencies and stablecoins are among the assets used to support BAC. In order to keep prices stable, these assets’ value is used.

Algorithmic stablecoins utilize rebasing as another approach. To keep the stablecoin’s price stable, rebasing entails altering the stablecoin’s supply. The algorithmic stablecoin raises the supply when the stablecoin price exceeds a particular threshold and reduces the supply when the stablecoin price falls below the threshold.

Empty Set Dollar (ESD) is a prime example of an algorithmic stablecoin that employs rebasing. To change the stablecoin’s supply, ESD uses a rebase function. An outlier from the target price of USD 1 causes the rebase mechanism to be activated.

Finally, algorithmic stablecoins employ a variety of methods to preserve price stability. Seigniorage shares, collateralization, and rebasing are some of these techniques. While each mechanism operates differently, they are all designed to keep the stablecoin’s price static. Ampleforth, Basis Cash, and Empty Set Dollar are a few examples of well-known algorithmic stablecoins that employ these techniques. Anyone who wants to invest in these digital assets must comprehend the workings of algorithmic stablecoins.

Benefits of Algorithmic Stablecoins

Algorithmic stablecoins have gained popularity in the world of cryptocurrencies due to their unique features and potential benefits over traditional cryptocurrencies.

Low Volatility

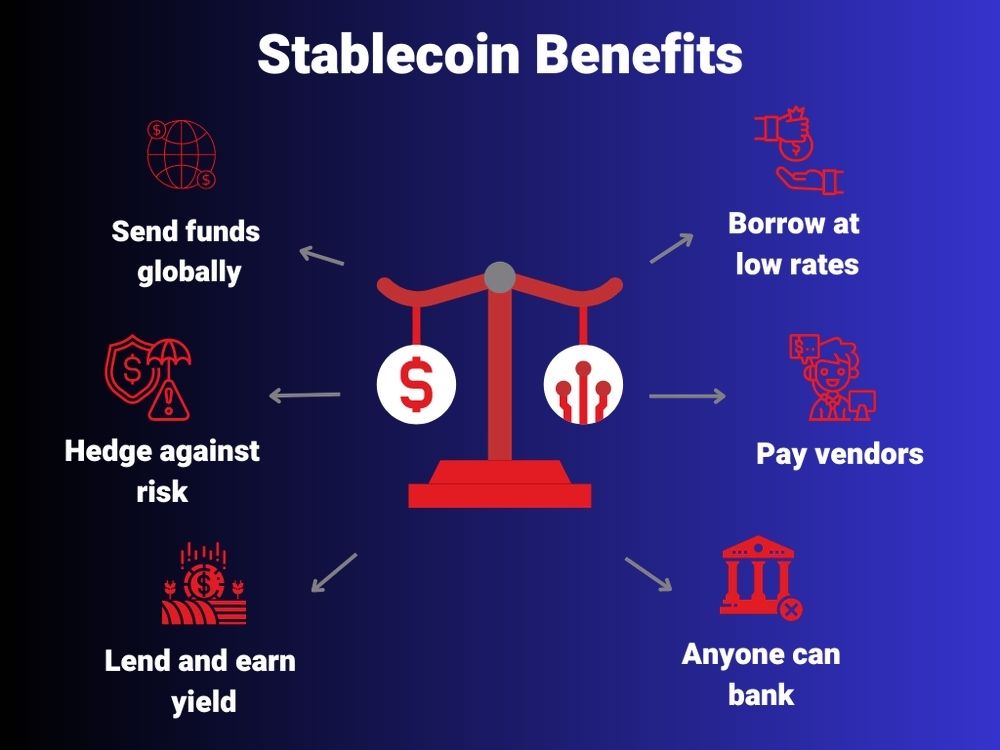

One of the primary benefits of algorithmic stablecoins is their lower volatility compared to traditional cryptocurrencies. Traditional cryptocurrencies such as Bitcoin and Ethereum are known for their price volatility, which can make them risky investments. In contrast, algorithmic stablecoins are designed to maintain a stable price, which makes them less volatile and more predictable.

Low Fees

Another benefit of algorithmic stablecoins is their lower transaction fees compared to traditional cryptocurrencies. Transaction fees can be a significant barrier to entry for individuals looking to invest in cryptocurrencies. Traditional cryptocurrencies often charge high transaction fees, which can make small transactions expensive. In contrast, algorithmic stablecoins typically have lower transaction fees, which makes them more accessible to a broader range of investors.

Access to Financial Services

Algorithmic stablecoins can also provide access to financial services for individuals in countries with unstable currencies. In countries with unstable currencies, it can be difficult to access traditional financial services, such as banking and lending. Algorithmic stablecoins can provide a stable and accessible alternative to these traditional financial services. For example, individuals in countries with unstable currencies can use algorithmic stablecoins to store value and make transactions without having to worry about the fluctuations of their local currency.

The Mean of Transactions

Finally, algorithmic stablecoins have the potential to be used as a medium of exchange in day-to-day transactions. Traditional cryptocurrencies have struggled to gain widespread adoption as a medium of exchange due to their price volatility. In contrast, algorithmic stablecoins are designed to maintain a stable price, which makes them more suitable for use as a medium of exchange. As more merchants begin to accept algorithmic stablecoins as payment, they could become a more convenient and widely used form of currency.

In conclusion, algorithmic stablecoins provide several advantages that make them a desirable investment choice. These advantages include less volatility than conventional cryptocurrencies, cheaper transaction costs, accessibility to financial services for those living in nations with unstable currencies, and the potential to be utilized as a means of exchange in everyday transactions. additional investors begin to recognize the benefits of algorithmic stablecoins, we will likely see increased adoption of these digital assets.

Risks of Algorithmic Stablecoins

Algorithmic stablecoins provide many advantages, but there are a couple of risks involved in investing in these digital assets:

One of the primary risks of algorithmic stablecoins is their relatively new and untested nature. Many algorithmic stablecoins have only been in existence for a few years, which makes it difficult to predict how they will perform over the long term. While these stablecoins may have been designed to maintain a stable price, unforeseen events such as a global economic crisis or a technological failure could still cause significant price fluctuations.

Another risk associated with algorithmic stablecoins is the potential for smart contract vulnerabilities. Smart contracts are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code. These contracts are used to automate the execution of certain tasks, such as the issuance and redemption of stablecoins. If a smart contract contains a vulnerability, it could potentially be exploited by bad actors to steal user funds.

This is another mechanism used by algorithmic stablecoins that comes with its own set of risks. When stablecoins are collateralized, they are backed by a reserve of assets, such as other cryptocurrencies or fiat currencies. If the value of these assets declines significantly, it could lead to a situation where the stablecoin becomes under-collateralized, and the value of the stablecoin could plummet.

Finally, there is a risk associated with the potential for regulatory crackdowns. As algorithmic stablecoins become more popular, regulators may begin to take notice and consider implementing regulations or even outright bans. If a regulatory crackdown were to occur, it could significantly impact the value of algorithmic stablecoins and make them a riskier investment.

In summary, algorithmic stablecoins come with a number of dangers, including the fact that they are still relatively new and unproven, the possibility of smart contract weaknesses, collateralization issues, and the possibility of governmental crackdowns. Investors should carefully assess their investment plan and be aware of these dangers before purchasing algorithmic stablecoins.

Comparison with Traditional Stablecoins

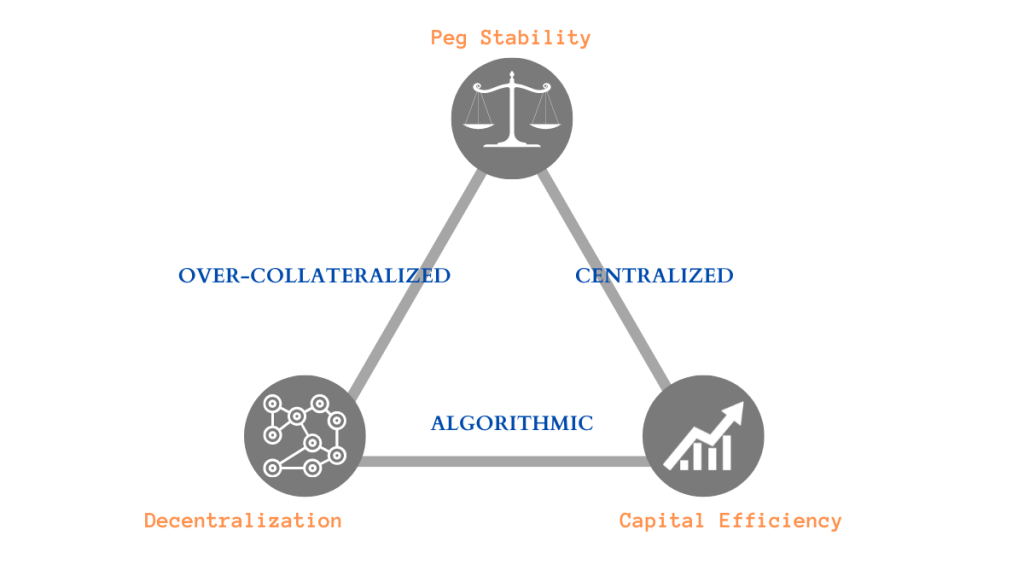

Due to their distinct methods and possible advantages over conventional stablecoins, algorithmic stablecoins have drawn interest in the cryptocurrency community. To comprehend the similarities and differences between algorithmic and conventional stablecoins, it is necessary to compare and contrast them.

Standard stablecoins are frequently backed by fiat money or other tangible assets like gold or silver. Since the value of these stablecoins is intended to maintain a 1:1 peg with the underlying asset, it should be more stable than that of the asset it is backed by. Traditional stablecoins are appealing to investors because of their stability and because they don’t have the volatility of other cryptocurrencies.

Algorithmic stablecoins, in contrast, employ sophisticated techniques to preserve their price stability. These stablecoins are supported by smart contracts that control the creation and redemption of stablecoins rather than tangible assets. In contrast to typical cryptocurrencies, these contracts utilize algorithms to alter the supply of stablecoins in accordance with market demand.

Lower transaction costs are one of the main advantages of algorithmic stablecoins over traditional stablecoins. When moving stablecoins between wallets, exchanges, or other users, users of traditional stablecoins often have to pay transaction fees. Algorithmic stablecoins, on the other hand, may be transferred for less money, making them a more alluring choice for consumers who wish to cut back on transaction fees.

The availability of algorithmic stablecoins to people in nations with unstable currencies is another advantage. It may be challenging for people to acquire stable financial services in these nations because traditional stablecoins are not always offered or generally accepted. On the other hand, algorithmic stablecoins may be used as a stable means of exchange in routine transactions, making them a desirable choice for people who reside in nations with unstable currencies.

Algorithmic stablecoins do, however, carry hazards that are absent from conventional stablecoins. Algorithmic stablecoins are very new and unproven, as was covered in the section above, which might make them dangerous investments. Algorithmic stablecoins may also be subject to governmental repression, collateralization issues, and smart contract exploitation.

Conclusion

As a new and unique type of cryptocurrency that has advantages over regular stablecoins, algorithmic stablecoins have arisen. Complex algorithms and smart contracts that support these stablecoins work to ensure price stability, reduce transaction costs, and make them accessible to people in nations with unstable currencies. Investors must take into account extra risks associated with algorithmic stablecoins, including regulatory repercussions, collateralization issues, and smart contract exploits.

Algorithmic stablecoins have acquired popularity in the cryptocurrency market despite these dangers and are currently being actively used and developed by several projects. It is conceivable that algorithmic stablecoins will become increasingly more complex and dependable as the underlying technology develops and matures.

Algorithmic stablecoins have the potential to transform the way we think about stable financial services in the future and may play a big role in the cryptocurrency ecosystem. It is unclear how the market for algorithmic stablecoins will develop, but these stablecoins certainly have the ability to provide special advantages to investors and people all over the world. Before investing in algorithmic stablecoins, it is crucial to do your research and do due diligence.

FAQ

How do algorithmic stablecoins differ from other types of cryptocurrencies, such as Bitcoin or Ethereum?

While Bitcoin and Ethereum have highly volatile prices, algorithmic stablecoins are designed to maintain a stable price through various mechanisms. Also, algorithmic stablecoins rely on supply and demand, in comparison to Bitcoin and Ethereum, which rely on complex algorithms.

How do algorithmic stablecoins maintain price stability?

Algorithmic stablecoins maintain price stability through seigniorage shares, collateralization, and rebasing.

What are some popular algorithmic stablecoins and what mechanisms do they use?

There are several popular algorithmic stablecoins, each using different mechanisms to maintain price stability. Here are some examples: Dai (DAI); TerraUSD (UST); Frax (FRAX); Ampleforth (AMPL); Empty Set Dollar (ESD).