Blockchain is a revolutionary technology, which was first conceptualized in 2008 by a person (or perhaps a team) nicknamed Satoshi Nakamoto, who’s also the creator of the most popular cryptocurrency – Bitcoin. Notwithstanding the big buzz around the technology, there is rarely a clear and deep understanding of what it really is or how it exactly functions.

Blockchain is based on an advanced database system, enabling one to transparently share information within a public or private network. In a blockchain database, information is stored in blocks that are linked together in a chain. Here the data is chronologically consistent, as nobody may modify or delete the chain without a consensus from the network participants. Thus, blockchain enables to secure share information or data concerning different transactions. It serves as a new-generation database or ledger, which is also known as distributed ledger technology (DLT).

With this article, we’ll try to dig beneath the surface chatter, aiming to understand what’s behind this impactful technology, what are the advantages of its use, and the potential risks which might pose a threat to its use in real-world applications. Thus, it will hopefully provide our reader with a deeper insight into this modern technology, its future development dimensions, as well as challenges it may face on that path.

Contents

What exactly is blockchain technology and how does it work?

Classical database technologies as we know them, face multiple challenges related to recording different types of transactions. For easier understanding, let’s take a real-life example: the sale of a property. Once the agreed price is paid, the property ownership should be transferred to the buyer. Individually, both sides can record the monetary transactions, however, neither source can be fully trusted. The sellers can easily claim they have not received the money even though they have, and the buyers can equally argue that they have paid the money even if they haven’t. To avoid potential legal issues, a trusted third party must supervise and validate such transactions. The presence of this central authority not only complicates the transaction but also creates a single point of vulnerability. If the central database would be compromised, both parties might suffer.

Blockchain technology provides solutions for mitigating such issues by creating a decentralized, tamper-proof system to record transactions. In the property transaction case, the blockchain creates one ledger each for the buyer and the seller. All transactions must be approved by both parties and are automatically updated in both of their ledgers in real-time. Any corruption in historical transactions is not possible, as it will corrupt the entire ledger as a result. These properties of blockchain technology have led to its use in various sectors, including the creation of Bitcoin – the famous digital currency.

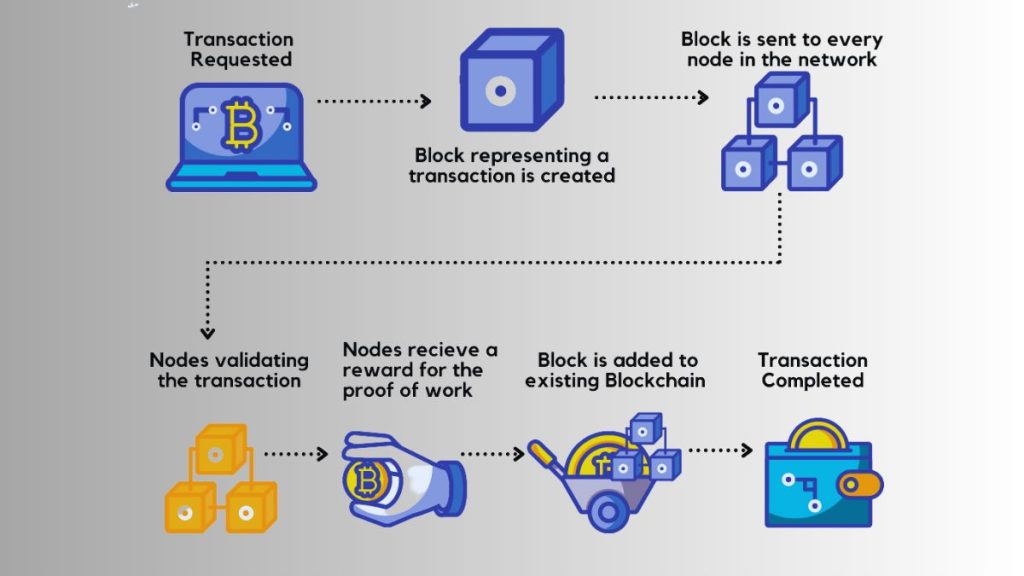

When data on a blockchain is accessed or altered, the record is stored in a “block” alongside the records of other transactions. Stored transactions are encrypted via unique, unchangeable hashes created with the help of algorithms. Importantly, new data blocks don’t overwrite old ones, they are appended together so that any changes can be monitored. And since all transactions are encrypted and records are immutable, any changes to the ledger can be recognized as being accepted or rejected by the network. These blocks of encrypted data are permanently “chained” to one another, and transactions are recorded sequentially and indefinitely, creating a perfect audit history that allows visibility into past versions of the blockchain.

Once new data is added to the network, the majority of nodes must verify and confirm its legitimacy based on permissions or economic incentives, also known as the consensus mechanism. When a consensus is reached, a new block is created and attached to the chain. All nodes are then updated to reflect the new blockchain ledger. Nodes are incentivized with digital tokens or digital currency to make such updates to the system. In a public blockchain network, the first node to credibly prove the legitimacy of a transaction receives an economic incentive – this process is called “mining”.

A blockchain has three important features: first, a blockchain database must be cryptographically secure. This means in order to access or add data to the system, you need two cryptographic keys – a public key, which is basically an address within the database, and a private key, which is a personal key that must be authenticated by the network. Next, a blockchain is a digital log or database of transactions, which is fully and permanently online. And finally, a blockchain is a database that is shared across a public or private network. One of the most well-known public blockchain networks is again the Bitcoin ecosystem, where anyone may open his/her own wallet or become a node on the network.

There are also many private or managed blockchain networks, like the ones which are created and used by banks, FinTech, or other companies. Here the network participants need to exactly know who is involved, who has access to their data, and who possesses the private key to the database. Other types of blockchains include consortium blockchains and hybrid blockchains, both of which combine different elements of public and private blockchains.

Proof-of-work and proof-of-stake: what’s the difference?

Hope you still remember the idea of the consensus mechanism mentioned earlier. There are two ways blockchain nodes arrive at a consensus: through private blockchains, where trusted corporations are the gatekeepers of changes or additions to the blockchain, or through public, mass-market blockchains.

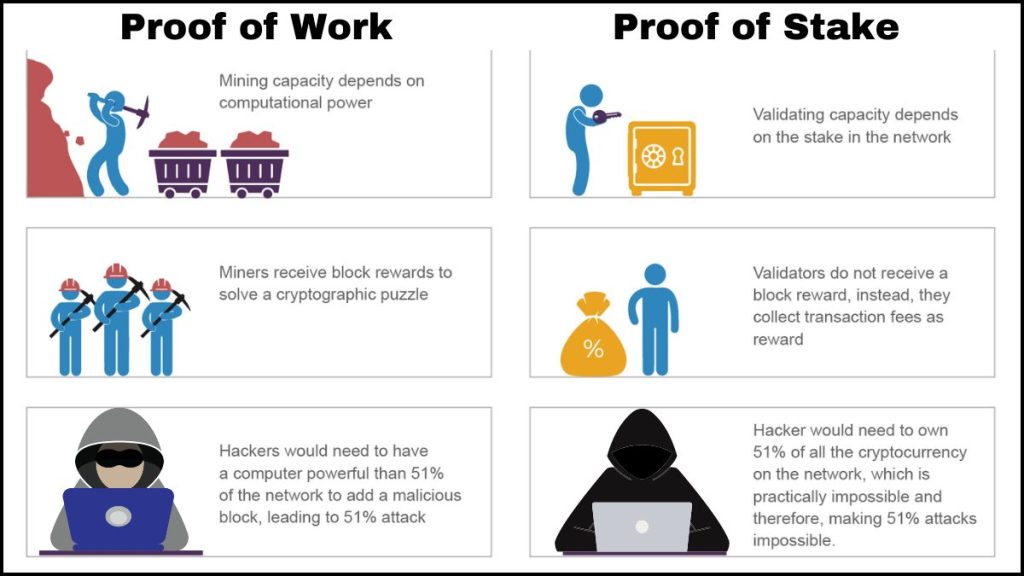

Most public blockchains arrive at consensus by either a proof-of-work or proof-of-stake system. In a proof-of-work system, the first node, or participant, to verify a new data addition or transaction on the digital ledger receives a certain number of tokens as a reward. To complete the verification process, the participant, or “miner,” must solve a cryptographic question. The first miner who solves the puzzle is awarded those tokens. Originally, people started mining on various blockchain networks as their new hobby. Later, as this process became quite lucrative, blockchain mining has been industrialized. These proof-of-work blockchain-mining pools have attracted attention for the large amounts of energy they consume.

In September last year, Ethereum – an open-source cryptocurrency network, addressed concerns about excessive energy usage by upgrading its software architecture to a proof-of-stake blockchain. Known simply as “the Merge,” this event is seen by crypto fans as a banner moment in the history of blockchain. With proof-of-stake, investors deposit their crypto coins in a shared pool in exchange for the chance to earn tokens as a reward. In proof-of-stake systems, miners are scored based on the number of native protocol coins they have in their digital wallets and the length of time they have had them. The miner with the most coins at stake has a greater chance to be chosen to validate a transaction and receive a reward.

Potential benefits for businesses

Research suggests that blockchain and DLTs could create new opportunities for businesses, increasing the cost-efficiency of their transactions, through automated and secure contract fulfillment and increased network transparency. More specifically, a diligent application of this technology may deliver the following benefits:

financial institutions rely on “know your customer” (KYC) processes to onboard new and retain their old customers. However, many existing KYC processes are outdated, generating multimillion-dollar costs every year. A new DLT system might require once-per-customer KYC verification, delivering efficiency gains, enabling cost reduction, improving transparency, and enhancing customer experience.

by digitizing records and issuing them on a universal ledger, companies may save significant time and costs.

applying smart contracts consisting of instruction sets, coded into tokens issued on a blockchain which can self-execute under specific conditions. These can enable automated fulfillment of contracts, saving additional resources for a business.

Alternative ways of using blockchain

Currently, blockchain technology is widely used by cryptocurrency ecosystems, however, this is just the tip of the iceberg. Use cases for blockchain are expanding rapidly beyond person-to-person exchanges, especially as it gets paired with other emerging technologies.

Other possible applications include but are not limited to the following:

- Companies may create an indelible audit trail through a sequential and indefinite recording of their transactions.

- Systems that keep static records of property titles for instance, or dynamic records like the exchange of assets, may also benefit from the transparent and immutable nature of the system.

- Businesses can track a transaction down to its current status, enabling them to determine where the data originated and how it was delivered, helping them to prevent data breaches.

- Firms and individuals can benefit from the use of smart contracts supported by the blockchain, which are programs that trigger transactions automatically upon fulfillment of certain criteria defined by the contract.

The Future of blockchain technology

Two primary development dimensions for blockchain in the current decade are expected to be:

- Growth of blockchain as a service (BaaS), which is a cloud-based service that builds digital products for DLT and blockchain environments without any setup requirements for infrastructure. Currently, this trend is being led by Big-Tech companies.

- Interoperability across blockchain networks and outside systems, meaning that independent blockchain networks and other external systems will be able to view, access, and share one another’s data while maintaining integrity. Hardware standardization and scalable consensus algorithms will enable cross-network use cases, such as the Internet of Things (IoT) on blockchain infrastructure.

These trends will be catalysed partly because of increasing pressure from regulators and consumers demanding greater supply chain transparency. Another driver may become the economic uncertainty, as consumers look for independent or centrally regulated systems. Here large corporations have an important role to play by launching successful pilots and building confidence for their consumers and other entities.

Security Concerns

Although blockchain has been named a “truth machine”, due to its capacity of eliminating many of the Web 2.0 issues primarily related to piracy and scamming, still it’s not the panacea for digital security challenges. The technology itself is essentially fool-proof however, it is only as noble as the people using it and as good as the data they are adding to it.

A motivated group of hackers could leverage the blockchain’s algorithm to their advantage by taking control of more than half of the nodes on the network. With this simple majority, the hackers may gain the consensus and thus the power to verify fraudulent transactions.

In 2022, hackers did exactly that, stealing more than USD 600 million from the gaming-centered blockchain platform Ronin Network. This challenge, in addition to the obstacles regarding scalability and standardization, will need to be addressed. Nevertheless, there is still significant potential for the application of blockchain, both for businesses and society.

Conclusion

Blockchain is a new generation technology, which allows for a permanent, immutable, and transparent recording of data and related transactions. By enabling that, blockchain also makes possible the exchange of anything that has value, whether it is a physical or a non-tangible asset. As a result, you may use it for creating an unalterable ledger for tracking orders, payments, and accounts, as well as other financial and non-financial deals.

Currently, multiple sectors actively apply solutions based on blockchain technology however, it has the widest use in the following industries: energy, finance, retail, mass media, entertainment, etc. As a result, both – public and private entities could achieve an increase in transparency in the movements of their goods and services, a significant reduction of time and costs involved in the fulfillment of certain tasks, improve the security level of their databases, and more.

This promising technology is expected to find new and interesting applications in the future. Particularly, its BaaS and IoT applications have very strong growth potential and there are already several large projects in the pipelines of the Tech Giants.

FAQ

What are the benefits of blockchain use?

Blockchain is a decentralized and transparent data recording technology, which allows for higher efficiency, as well as faster and cheaper processing of various transactions on public or private networks.

What is BaaS?

Blockchain as a Service or BaaS is a managed blockchain service available in the Cloud. Anyone may develop blockchain applications and digital services on it, as the Cloud provider supplies the infrastructure and building tools – users just need to customize existing solutions to their needs. This accelerates the adoption of blockchain, making it more user-friendly and efficient for companies and other groups.

What is the potential economic impact of blockchain technology?

Recent research suggests that by 2030, as much as around 10% of global GDP could be associated with blockchain-enabled transactions.