Decentralized exchanges – also known as DEXes – have become increasingly popular over time as an alternative to traditional finance and centralized exchanges.

They offer full transparency, users have full control over their assets when they use a decentralized exchange: in fact, the peculiarity of DEXes is that there is no need for intermediaries.

They work based on a decentralized network, where every participant has the same rights and decisional power. All this is possible thanks to smart contracts.

Decentralized exchanges can be used to trade digital assets and use financial services that allow users to manage their funds autonomously.

The goal of this article is to provide an in-depth guide to decentralized exchanges: how they work, what are their advantages and disadvantages, the different types of DEXes currently available, and how to use them.

We will provide you with all the information related to this innovative type of exchange, capable of fully respecting the principles of public blockchain technology and decentralized networks.

Contents

What’s the difference between decentralization and distribution?

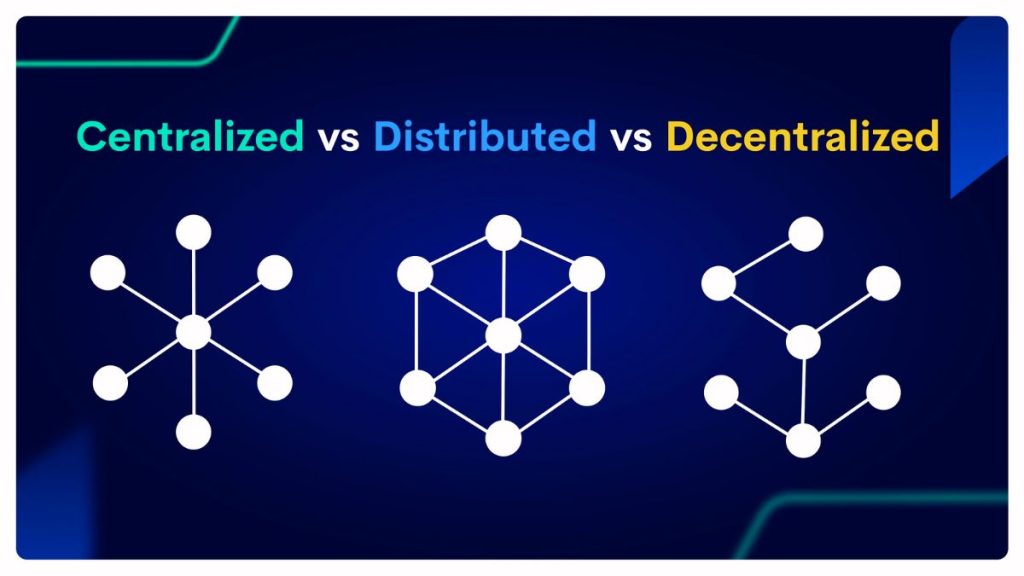

We’ve already mentioned that decentralized exchanges are decentralized, and they are also distributed. But what’s the difference between these two terms often used when talking about cryptocurrencies and blockchain technology?

While distribution indicates the quality of a network to be composed by different and separated entities. Decentralization means that the control of a network doesn’t depend on a single entity, but every participant has the same rights.

To be more specific, let’s consider that while a blockchain is distributed both when it’s public and when it’s private or hybrid, it is not necessarily decentralized. For instance, a private blockchain can be controlled by a single entity.

What are Decentralized Exchanges?

Decentralized exchanges, as the name suggests, are not only distributed but also decentralized.

They are innovative types of cryptocurrency exchanges managed by decentralized networks of nodes thanks to smart contracts.

Differently from centralized exchanges, where operations are managed and controlled by single entities and companies, decentralized exchanges work autonomously according to a predetermined set of rules and algorithms organized and created thanks to smart contracts.

The network represents the very infrastructure of DEXes, and each participant is able to work even without knowing other participants precisely thanks to this predetermined set of rules.

What are smart contracts?

Even if smart contracts seem to be something very recent, they were proposed by Nick Szabo in the nineties.

They represent pieces of code that can be executed on the blockchain. Another way to see them is that smart contracts can be seen as agreements able to auto execute according to pre-set rules.

Actually, a quality of smart contracts is that they don’t work if not all the conditions set are met.

This allows them to be considered safe – even if there are some types of attacks that involve precisely smart contracts, as we will see later, and a precious tool to automate operations occurring on blockchains.

How do Decentralized Exchanges work?

To better understand how DEXes work, it is important to mention that there are different types of decentralized exchanges. The main types are AMM (Automated Market Makers), Aggregators and Order Books Decentralized Exchanges.

The thing they have in common is that they use smart contracts to work. Let’s dive deeper into the topic:

This type of DEX works thanks to liquidity pools. These are founded by users, called liquidity providers, who have to deposit different currencies according to shares determined by the smart contract. A liquidity provider who tries to deposit funds in a different way, the transaction is not validated – precisely because smart contracts need rules to be respected. When a liquidity provider deposits funds, he or she is entitled to receive part of the fees paid by other users to make transactions that involve that specific liquidity pool. An example of AMM is Uniswap. An important part to understand is that, differently from what happens with centralized exchanges, when you use an AMM you are trading against the pool, and not against other traders or investors. Another important point is that Automated Market Makers use the so-called oracles to set prices: the AMM gathers information about the state of different markets, in order to provide fair prices, which would be otherwise subject exclusively to the decisions of users.

liquidity – as we will see later – is a pivotal factor of decentralized exchanges, and it is also the main factor related to the possible disadvantages connected with decentralized exchanges. Aggregators don’t rely only on liquidity providers, but collect liquidity from different decentralized exchanges. A popular aggregator is 1 inch.

this type of decentralized exchange is more similar to centralized exchanges. In fact, here there is a sort of list of buying and selling orders, and it’s the spread between these different types of orders that determines what is the price that has to prevail. This type of mechanism is used by decentralized exchanges like dYdX.

As mentioned, these different types of exchanges have in common smart contracts to work autonomously. It will be the set of rules that will determine what transactions can be finalized and the ones that have to be rejected.

How to Use DEXes

But how can traders and investors use decentralized exchanges?

As we said, decentralized exchanges follow the principles that led to the creation of blockchain technology, more than centralized exchanges.

One of these principles is privacy.

Decentralized exchanges work thanks to smart contracts in a decentralized and inclusive environment.

To be a part of the decentralized space, people do not need to communicate their personal details to be able to use financial services and products.

Differently from what happens with centralized exchanges, or with traditional financial institutions, there is not a registration process.

The only thing people need to use a decentralized exchange is a decentralized wallet – the most popular example of decentralized wallet is MetaMask.

To use this type of wallets, which are usually provided in the form of browser extensions, users need to open a new wallet, write down (and save offline) a seed phrase – which will allow them to recover their assets in case they will change or lose their devices, and set a password.

To use a decentralized exchange, users need to navigate the exchange they chose, and choose to connect their wallets.

Different exchanges can support different decentralized wallets.

Once users connect their wallets, they will be able to make transactions on the exchange, and they’ll need to sign each transaction to confirm that they have the authority to use the funds involved.

All this happens in total privacy and without the need to share personal information, since everything works thanks to public addresses and private keys, which are just strings of numbers and letters that reveal nothing about the identity of the user.

Decentralize Exchanges (DEX) – Key concepts

- Decentralization: this characteristic pertains to networks that are not controlled by central authorities and intermediaries. Decentralized exchanges fall under this category.

- Smart contracts: these on-chain programs allow decentralized exchanges to work according to a predetermined set of rules, which allows autonomy, privacy and the distinction between valid and invalid transactions.

- Liquidity: liquidity is a concept that refers to the capability of an asset to be sold and acquired at market price. The more liquid a market, the easier it will be for it to keep a price that reflects its value. And the easier will be for traders and investors to make transactions without incurring in liquidity-related issues (more about this later).

- Liquidity providers: liquidity providers are users that provide liquidity to a protocol – that is, they deposit funds. They play a pivotal role in the decentralized ecosystem, since the very functioning of a DEX depends on them.

- Decentralized wallets: these are the tools that allow users to use decentralized exchanges, providing them with keys and integration, as well as a place where to store funds.

Pros and Cons of DEXes

Now that we’ve analyzed the key concepts and the functioning of DEXes, it’s time to analyze not only the advantages, but also the disadvantages of these innovative platforms.

Advantages of decentralized exchanges when compared to centralized exchanges

- Decentralized exchanges don’t need intermediaries – they work thanks to smart contracts;

- Because of the previous point, users have full control over their assets – they manage their funds and interactions with the decentralized exchange thanks to decentralized wallets;

- Privacy: users don’t need to share any personal details and there’s no registration or verification process. They’re represented by strings of numbers and letters that form public addresses and private keys.

Disadvantages and limitations of decentralized exchanges

- The level of privacy granted by decentralized exchanges means, on the other hand, that DEXes are in a gray area for what concerns regulation. Since there is no KYC (Know Your Customer) process, there’s no possibility to identify users, and since everyone can use decentralized exchanges – as long as they have an internet connection and a decentralized wallet – everyone can create liquidity pools for new tokens – also for scams.

- Smart contracts, despite the advantage related to the fact that they don’t need the intervention of humans when they’re on the blockchain, are not necessarily safe. For instance, there can be bugs, or creators might intentionally create codes that limit the control users have over their funds.

- In general, decentralized exchanges need a higher level of knowledge of blockchain technology and the crypto environment in general. For instance, a user who’s not familiar with smart contracts might not be able to spot risks related to these programs. Moreover, users need to remember that there’s no support if they lose their keys – since there’s no centralized database that manages accounts.

- Liquidity-related issues. As mentioned, decentralized exchanges mainly depend on liquidity providers. If a DEX doesn’t manage to get enough liquidity, some of the consequent issues can be slippage (the difference in price experienced by an asset from the moment when a trade is opened to the moment when the trade is actually executed) and impermanent loss (price decreases after a liquidity providers provides liquidity. As long as he doesn’t withdraw funds, the loss is impermanent – it will become permanent if he decides to withdraw funds). In general, low liquidity means high volatility, and this means that users are more easily subject to losses.

Conclusion

Decentralized exchanges (DEXes) represent one of the most interesting solutions adopted in the decentralized financial environment.

They allow people to manage their funds as they would do with a bank account – but being in full control of their assets and without the need for intermediaries.

Decentralized exchanges are the platform used to exchange digital assets, get access to pools that allow to borrow funds, and invest in services similar to savings accounts, but users won’t need to go through a registration process, or to have a good credit score to have access to the financial possibilities offered by decentralized exchanges.

Nevertheless, there are also risks and limitations, not only related to the ambiguous regulatory state of DEXes, but also to liquidity.

In general, when users want to use decentralized exchanges, they need to be aware of limitations and risks, and have a deeper knowledge of the blockchain-based financial system than the knowledge they need when using centralized exchanges.

FAQ

What are decentralized exchanges (DEX)?

Decentralized exchanges – also referred to as DEXes – are blockchain-based crypto exchanges that work on decentralized networks thanks to smart contracts.

What are the advantages of decentralized exchanges?

Decentralized exchanges allow users to fully control and manage their assets, without the need for intermediaries and without giving up on transparency and privacy.

What are the risks and limitations involved in the use of DEXes?

The main risks and limitations associated with decentralized exchanges concern liquidity – a possible lack of liquidity can lead users to relatively higher losses because of volatility. Moreover, users can’t get the support they would get with centralized exchanges if any problem arises.