Decentralized finance (DeFi) is a newly emerging technological dimension, which allows its users to execute financial transactions directly between the counterparties, cutting out the middleman. It’s rapidly gaining popularity as a more modern and efficient way of offering traditional or alternative financial services. DeFi already lets us use many of the services offered by banks and other centralized financial institutions. In addition, new products and features are being regularly added to their platforms, making them even more attractive for the clientele over time.

The underlying foundation of DeFi is blockchain technology, hence all DeFi operations are conducted using blockchain networks, most often Ethereum as an open-source platform. By doing so, the financial transactions become quicker, cheaper, and more efficient for the counterparties involved. When using DeFi, anyone may store and access her/his funds by creating a secure digital wallet and entering into smart contracts in order to make the transactions they’d need to execute. This gives the participants access to a wide range of financial services, from peer-to-peer lending to trading stocks or digital assets through decentralized exchanges. Another key feature is that DeFi is open to anyone with an internet connection, making finance far more accessible for all.

In this article we’ll take a closer look at how decentralized finance works, how it differs from classical forms of finance as we know it, also how it relates to blockchain technology, as well as its broad range of applications from currency exchange, various payments to digital asset lending, to name a few.

Contents

- 1 What exactly is DeFi and how does it work?

- 2 Decentralized vs Centralized Finance

- 3 DeFi applications on Ethereum and the role of smart contracts

- 4 Current and future applications of DeFi

- 5 Wallets and aggregators explained

- 6 DeFi borrowing and lending opportunities

- 7 Currency exchanges by DeFi

- 8 DeFi stablecoins

- 9 Conclusion

- 10 FAQ

What exactly is DeFi and how does it work?

DeFi refers to decentralized financial services on blockchains as opposed to “centralized” financial services provided through banks or other traditional financial institutions. It serves participants of the ecosystem by using cryptocurrency, providing most of the services that traditional banks offer with government-issued fiat currencies – allowing them to lend, borrow, earn interest, trade assets, buy insurance, and more. DeFi-based services tend to be faster, cheaper, and simpler, with new advantages and services being added regularly.

In doing so, it uses smart contracts that don’t require traditional financial institutions to act as guarantors of transactions. Instead, counterparties conduct their deals with each other directly in the decentralized environment, while transactions are secured through blockchain technology. Most DeFi products don’t take custody of your funds, hence you remain in control of your assets throughout the process.

In the DeFi universe, anyone has access to her/his funds or other assets via a secure digital wallet. Once a transaction needs to be initiated, it runs on smart contracts, which means you and the other party agree to some specific conditions. For instance, a smart contract can be created to send funds to a particular account regularly, and this will continue provided your wallet has enough funds available to fulfill your instruction. Once a smart contract is set up, it cannot be altered, meaning that your funds can’t be re-routed and sent to a different account, for instance.

Most DeFi applications are built on Ethereum, although other blockchain-based platforms, like Cardano, Binance, and Solana, are quickly developing comparable applications, too. All in all, decentralized finance is still in its infancy phase, compared to centralized finance systems, hence it’s also much more dynamic in its development and innovation pace. We see announcements about new applications being released nearly every week.

Decentralized vs Centralized Finance

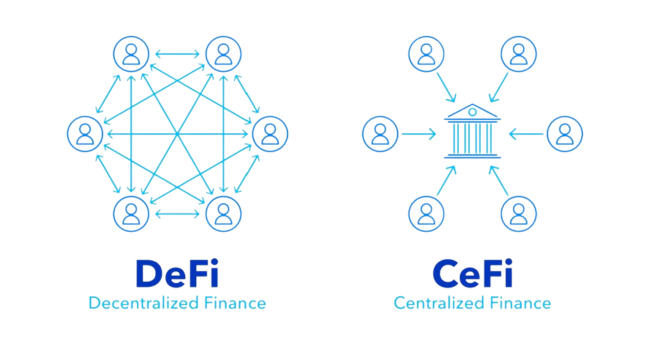

Centralized finance is the traditional financial environment we were living in since the first credit institutions emerged a long time ago. One of its fundamental features is that all payments, loans, savings, exchange, and trading operations are passed through third-party intermediaries, which are steadily supervised by national regulators. Decentralized finance, on the other hand, opens a whole new horizon of advantages for its participants by enabling everyone to transact via blockchain-based apps, cutting out the middlemen, such as banks&Co.

This cuts costs indeed, meanwhile adding speed and transparency to the subject financial operations. Additionally, DeFi makes these services much more accessible, especially to unbanked groups of society. In the world of centralized finance, not everyone is allowed to open a bank account or provide access to other financial products. So DeFi has the potential to financially empower billions of people globally, who currently have no access to financial institutions and their services.

DeFi also has the extra advantage of more flexibility. For example, the offered trading hours usually being accessible around the clock as a 24/7 service and not being limited to entities that are part of the centralized finance world.

DeFi applications on Ethereum and the role of smart contracts

As a blockchain platform, supporting decentralized apps (dApps) and smart contracts, Ethereum is naturally perfectly suited for DeFi. The Ethereum network maintains the transaction history and status of accounts, while Ether and other cryptocurrencies are used as assets for payment settlement and other purposes. Smart contracts are in turn used by dApps, creating new and more sophisticated smart contracts. As DeFi is an open-source movement, its protocols and applications are widely accessible to everyone wishing to use those.

Ethereum is known for its flexibility, enabling developers to build dApps with ease. This flexibility means there’s already a DeFi solution for most financial services, with the ongoing possibility of adding new, innovative products. Since so many DeFi applications are built on the Ethereum platform, many of these solutions can work together seamlessly, which is a great advantage boosting the future development of this field.

All this is possible thanks to the concept of “smart contracts”, which are essentially self-executing protocols on a blockchain network. Each party to a contract inputs conditions that allow the smart contract to be fulfilled without the need for intervention from another entity or a third party. Smart contracts use simple “if this … then …” algorithmic instructions written in code and run completely automatically, once the previously established conditions are met.

We may use them for sending funds to a particular digital account or wallet address with a predefined amount, on a specific date and time of the day (including after-work hours and weekends). Smart contracts are seen as a more secure, transparent, and efficient way for parties to execute financial operations with each other if compared to regular banking as we know it. Furthermore, they enable significant cost and time savings, as expensive bureaucracy is bypassed.

Current and future applications of DeFi

As already mentioned, the Ethereum platform lets you send digital assets to any corner of the globe cheaply and with great ease. While borrowing and lending are key advantages of DeFi and are already quite broadly available, there are also saving apps, where users may earn interest on crypto. Moreover, other financial services such as asset trading, fund management, insurance, etc. are there to be used via several apps to choose from.

In addition, there are other interesting applications – both in terms of currently evolving and future opportunities, opening near to endless horizons for the use of the multidimensional potential offered by the DeFi universe. Among those, the main ones worth mentioning in this article are listed below:

- Wallets and aggregators,

- DeFi borrowing and lending,

- Currency exchanges by DeFi (DEXs),

- DeFi stablecoins.

Wallets and aggregators explained

Aggregators are the interfaces by which users interact with the DeFi market. In the most basic sense, they are decentralized asset management platforms that automatically move crypto assets between various platforms to generate the highest possible returns.

Wallets are locations for holding and transacting with digital assets. These can store single or multiple assets and may appear in many different forms, including software, hardware, and exchange wallets. There are self-hosted wallets, which one can manage with personal private keys have a great potential of becoming a dominant feature of DeFi, helping to facilitate various DeFi platform uses. Meanwhile, exchange-based wallets, in contrast, are governing the above-mentioned private keys for their users, thus giving you less control and lower security responsibility at the same time.

DeFi borrowing and lending opportunities

Rapidly growing in popularity, DeFi lending and borrowing apps allow users to respectively borrow or lend digital assets from/to each other while earning interest. Lenders can pool their assets with others, setting the transaction terms through smart contracts. Borrowers generally need to post collateral in digital currency to secure loan approval. This implies that the latter group can, access funds in a major coin such as Bitcoin for example, while posting collateral in a more obscure cryptocurrency. If one borrows through a DeFi app, provided she/he makes the interest payments fully and on time, there’d be no need of selling the underlying collateral for gaining access to the loan in Bitcoin. In some apps, you may even leverage your collateral, borrowing an amount larger than the collateralized value.

Currency exchanges by DeFi

DeFi currency exchanges or DEXs, are peer-to-peer platforms enabling digital asset traders to exchange cryptocurrencies with each other. Not only do DEXs facilitate direct trading between participants, without third-party involvement, but they also secure the complete anonymity of counterparties engaged. Users most often maintain control over their wallets and may access thousands of different digital tokens for their planned trading or exchange operations via private keys they possess.

DeFi stablecoins

Pegged to stable currencies like the USD or a valuable commodity such as gold, stablecoins aim to eliminate the elevated volatility associated with most cryptocurrencies. This means that stablecoins tend to be better suited for everyday transactions than other highly volatile cryptocurrencies. These digital coins are easy to transfer around the world, which makes sending large amounts of money more affordable and significantly faster. Additionally, stablecoins also allow users to earn interest income by staking them through many DeFi apps.

Conclusion

The concept of DeFi was first introduced in 2018 by a group of Ethereum developers and entrepreneurs, aiming to provide an equal-opportunity financial landscape for the general public. In conventional banking, the intermediary institution possesses authoritative power in overseeing the execution of each transaction. DeFi is the antithesis of that, denying a particular entity access to controlling basic financial operations being handled between transaction counterparties.

Thus, decentralized finance is focused on building a new financial service universe that is completely separate from the traditional financial and political systems. This would allow for a more open ecosystem and could potentially prevent precedents of censorship, financial surveillance, fraudulent activities, and discrimination worldwide. Meanwhile, in terms of revenue, the DeFi market size was estimated at around USD 11,96 billion in 2021 with a projection of USD 232,2 billion by 2030. This implies a compound annual growth rate (CAGR) of nearly 43%, which is truly an impressive pace.

The concept is tempting indeed, however not every dimension of finance may benefit from decentralization. Finding the best use cases that are most suitable for the characteristics of blockchain is crucial in building a valuable cluster of open financial services. And if successful, DeFi could take power away from large centralized organizations and put it in the hands of the open-source community and ultimately each of us. Whether that will create a more efficient financial system might be seen once DeFi will be a subject of broad, mainstream adoption.

FAQ

Which platforms are DeFi apps being developed on?

While the original home of decentralized finance was Ethereum, several blockchain platforms featuring smart contract capabilities like Solana, Polkadot, BNB Smart Chain, Fantom, Avalanche, and others now host DeFi apps.

What’s the role of smart contracts in decentralized finance?

Various use cases of DeFi assume the creation and execution of smart contracts, which are essential to its applications. Contrary to standard ones, smart contracts use computer codes and are enforced in an automated manner, without manual involvement or supervision. Thus smart contracts are simpler, faster, and lower-risk for the parties.

What are the risks for the users of DeFi?

While the DeFi universe offers appealing annual percentage yields, those don’t come risk-free. One should remember that it’s still about using financial services (even though decentralized), and some of the risks are similar to those of traditional finance, particularly such as counterparty, regulatory, software-related, etc.