The world of day trading crypto can be exhilarating, challenging, and potentially lucrative. As digital currencies have gained mainstream recognition and adoption, more and more individuals are looking to enter the market and try their hand at trading. However, the volatile nature of cryptocurrencies means that day trading can be a high-risk, high-reward endeavor. Without proper knowledge, preparation, and risk management strategies, it’s easy to fall prey to common mistakes and lose significant sums of money.

For individuals who have a thorough grasp of the market and the technical analysis involved, day trading can be a very lucrative endeavor. However, because of the significant volatility and price swings in the cryptocurrency market, it may also be a dangerous pastime. To be successful, you need discipline, patience, and a solid trading plan.

Due to its enormous potential for development and decentralization, cryptocurrency, a relatively new asset class, has received a lot of attention in recent years. Day trading cryptocurrency may be a profitable method to become involved in this quickly expanding industry and profit from its volatility. Additionally, it helps diversify a portfolio of investors and lower total risk exposure.

In conclusion, day trading cryptocurrencies is purchasing and selling digital assets in a single day in order to profit from price swings. Although it has the potential to be lucrative, discipline, perseverance, and a strong trading technique are necessary for success.

This guide will arm you with the information and abilities you need to successfully navigate the challenging and fascinating world of day trading cryptocurrency, whether you’re an experienced trader trying to diversify your portfolio or a novice just getting started. So, let’s dive in!

Contents

Getting Started with Day Trading Crypto

Trading platforms and analysis tools are essential components of day trading crypto. They provide access to the cryptocurrency markets and enable traders to analyze market trends, identify opportunities, and execute trades. Popular trading platforms include Binance, Coinbase Pro, and Kraken, while common analysis tools include technical indicators, chart patterns, and candlestick charts.

Choosing a trading platform is the first step in beginning a day trading cryptocurrency strategy. There are several trading platforms to choose from, each with its features, costs, and safety measures. It’s crucial to conduct your own research and pick a platform that suits your requirements and preferences. Binance, Coinbase Pro, and Kraken are some of the prominent trading platforms for day trading cryptocurrencies.

Once you have chosen a trading platform, the next step is to set up an account. This typically involves providing your personal information, such as your name, address, and email address. You will also need to create a username and password to access your account.

You must fund your account after creating it to begin trading. You may usually deposit money using several different payment options, including bank transfer, credit card, and cryptocurrency. Additionally, you might be required to go through a verification procedure to comply with the legal requirements and maintain the security of your account.

Strategies for Day Trading Crypto

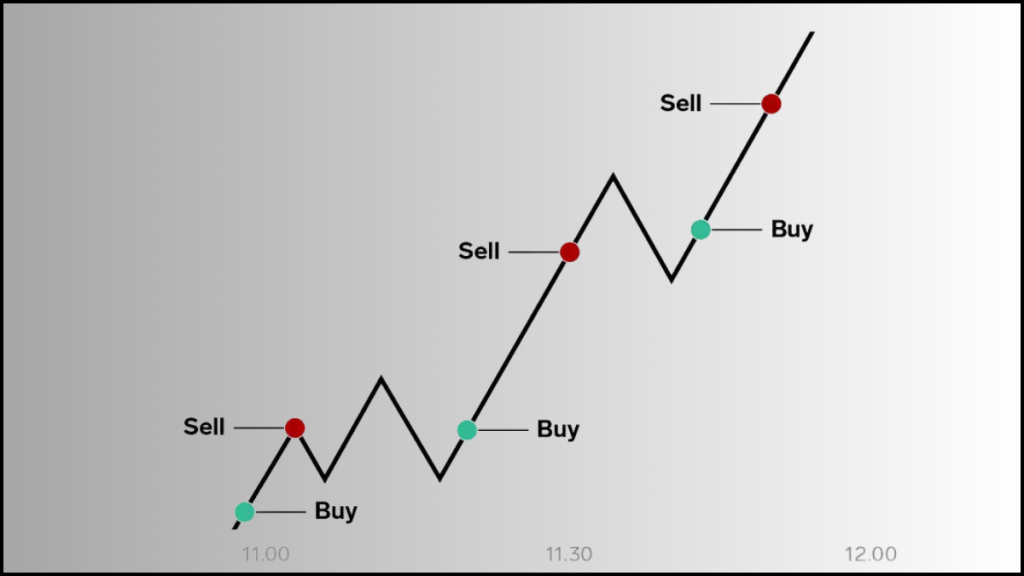

A good trading strategy is essential for the extremely volatile and quick-paced activity of day trading cryptocurrency. To evaluate the cryptocurrency market and find successful trading opportunities, traders employ a variety of tactics.

- Technical analysis

- Fundamental analysis

- Chart patterns

- Candlestick patterns

are some of the most widely used day trading components for cryptocurrencies.

A trading approach known as technical analysis looks at historical market data, such as price and volume, to spot patterns and trends that may be utilized to forecast future price changes. Moving averages, MACD, RSI, and Fibonacci retracements are just a few of the tools and indicators that technical analysts employ to assess market data and make trading choices.

The fact that technical analysis can be used to study any asset class, including cryptocurrency, is one of its main merits. However, it necessitates a thorough knowledge of the market and the relevant technical indicators. Technical analysts must be able to decipher market data and act quickly on the results of their study.

Fundamental analysis is a trading strategy that involves analyzing the underlying factors that affect the value of an asset, such as economic indicators, company financials, and news events. Fundamental analysts look at a variety of factors, such as market capitalization, transaction volume, and adoption rate, to determine the intrinsic value of a cryptocurrency.

One of the key advantages of fundamental analysis is that it can provide a long-term perspective on the value of a cryptocurrency. However, it requires a deep understanding of the cryptocurrency market and the underlying factors that affect its value. Traders who use fundamental analysis must be able to analyze a wide range of data and make informed decisions based on their analysis.

Technical analysis of chart patterns looks for patterns in price and volume data to forecast future price movements. Triangles, double tops and bottoms, and head and shoulders are typical chart designs. A probable trend reversal or continuance is sought after by traders who employ chart patterns.

Chart patterns include the visual depiction of market data as one of its main benefits, making it simpler to see trends and patterns. However, they need a thorough knowledge of technical analysis and the relevant chart patterns. Chart pattern traders need to be able to spot patterns and use these indications to their trading advantage.

The Technical analysis technique, known as candlestick patterns use the open, high, low, and close values of a cryptocurrency to forecast future price movements. Candlestick charts provide price information and a visual representation, and they may be used to spot trends and patterns like doji, hammer, and engulfing patterns.

The fact that candlestick patterns offer a more in-depth picture of market data than conventional price charts is one of their main attractions. However, they need a thorough knowledge of technical analysis and the relevant candlestick patterns.

Risk Management in Day Trading Crypto

Cryptocurrency day trading may be a high-risk endeavor, therefore it’s crucial for traders to have a reliable risk management strategy in place. Some effective risk management techniques for day trading cryptocurrency include:

A stop-loss order is a request made to a broker to sell a cryptocurrency at a specific price in an effort to reduce the risk of an investment going wrong. Stop-loss orders are a tool that traders may employ to safeguard their funds and reduce their exposure to market volatility.

The risk/reward ratio compares a trade’s possible loss to its potential gain. The risk/reward ratio may be used by traders to determine if a transaction has the potential to be profitable and to change the size of their position accordingly.

Day trading cryptocurrency may be a very emotional activity, therefore traders must keep a level head and refrain from taking rash actions motivated by greed or fear. To assist regulate their emotions and have a disciplined trading strategy, traders might utilize methods like meditation, mindfulness, and journaling.

By putting these tactics into practice, traders may better safeguard their funds and improve their chances of success when day trading cryptocurrencies. It’s crucial to remember that each trader’s risk management strategy will be particular to their own objectives, preferences, and trading manner. Traders may reduce their risks and maximize their earnings in this exciting and fast-paced market by taking the time to create a strong risk management strategy and continuously putting it into practice.

Dos and Don’ts When Day Trading Crypto

Following news and events is among the most important factors when day trade cryptocurrency. News and events have a significant impact on the crypto market, so keeping up with them may help traders make better judgments. To keep up with the most recent market movements, traders can use a variety of information sources, including trading forums, social media, and cryptocurrency news websites.

Utilizing a trading journal is another excellent practice for day trading cryptocurrency. An instrument that traders may use to keep track of their deals, log their thoughts and feelings, and assess their success over time is a trading diary. Traders may learn from their errors, pinpoint their strengths and limitations, and create a more successful trading strategy by maintaining a trading log.

Another essential best practice for day trading cryptocurrency is to learn from mistakes. Every trader will have setbacks at some time, and it’s critical to take advantage of these losses to grow. Reviewing deals allows traders to figure out what went wrong, better future trades, and learn from their mistakes.

Another excellent practice for day trading cryptocurrency is to have reasonable expectations. Traders must comprehend that there is no profit guarantee in day trading and that it is not a get-rich-quick program. Traders should work on developing a dependable and successful trading technique over time while setting reasonable goals for themselves.

FOMO (Fear Of Missing Out) is a typical error to avoid while day trading cryptocurrency. A psychological phenomenon known as FOMO causes traders to feel pressured to execute transactions out of fear of missing out on prospective gains. This may result in rash and foolish choices that might cost you a lot of money. Traders need to be conscious of their feelings and refrain from making choices based on FOMO.

Overtrading is another typical error to avoid while day trading cryptocurrency. The act of making too many deals quickly is referred to as overtrading. This may result in fatigue, errors, and a loss of concentration. Traders should prioritize quality over the number of transactions, executing only deals that satisfy their standards and are consistent with their trading strategy.

Another major error to avoid while day trading cryptocurrency is not having a trading plan. A trading strategy is a collection of rules that traders may use to decide how to trade sensibly and consistently. Without a trading strategy, traders are more likely to act impulsively and emotionally, which can lead to substantial losses.

Finally, another typical error to avoid while day trading cryptocurrency is disregarding market patterns and news. Traders who don’t keep up with the newest market developments risk missing out on chances or making poorly informed transactions. Market news and trends should be followed by traders for making wiser trading choices.

Conclusion

For those who have a firm understanding of the market and the technical analysis involved, day trading cryptocurrencies is a high-risk, high-reward activity that can be thrilling, difficult, and possibly profitable. But it’s crucial to exercise restraint, be patient, and have a sound trading strategy. Whether you’re a seasoned trader trying to diversify your portfolio or a beginner just starting started, this article will provide you with the knowledge and skills you need to successfully navigate the difficult and exciting world of day trading cryptocurrencies.

Day trading cryptocurrencies requires the use of trading platforms and analytical tools. They provide traders access to the cryptocurrency marketplaces, allowing them to research market movements, spot trading opportunities, and eventually place transactions. Technical indicators, chart patterns, and candlestick charts are typical analytical tools, and well-known trading platforms include Binance, Coinbase Pro, and Kraken.

FAQ

What are the benefits of day trading crypto?

Cryptocurrency day trading has the potential to deliver significant rewards in a short period of time. Additionally, because it is open 24/7, traders can benefit at any moment.

How do I start day trading crypto?

You must register with a cryptocurrency exchange, fund your account, and then start placing buy and sell orders. Before trading, it’s crucial to learn about the exchange’s costs and security measures.

What should I look for in a crypto exchange for day trading?

It’s crucial to take into account aspects like trading costs, security precautions, and the variety of cryptocurrencies offered for trading when selecting a cryptocurrency exchange for day trading.