Gary Gensler, the chair of the Securities and Exchange Commission (SEC), appeared before Congress on 18 April to answer questions regarding his controversial actions and how he administers the federal agency. In the meeting, Gensler’s actions and the SEC’s approach toward digital asset regulations were questioned numerous times.

Gary Gensler, the chairman of the Securities and Exchange Commission (SEC), found himself in the line under fire from Republican lawmakers in a heated exchange during a hearing today. The subject of the inquiry was the SEC’s approach to regulating digital assets.

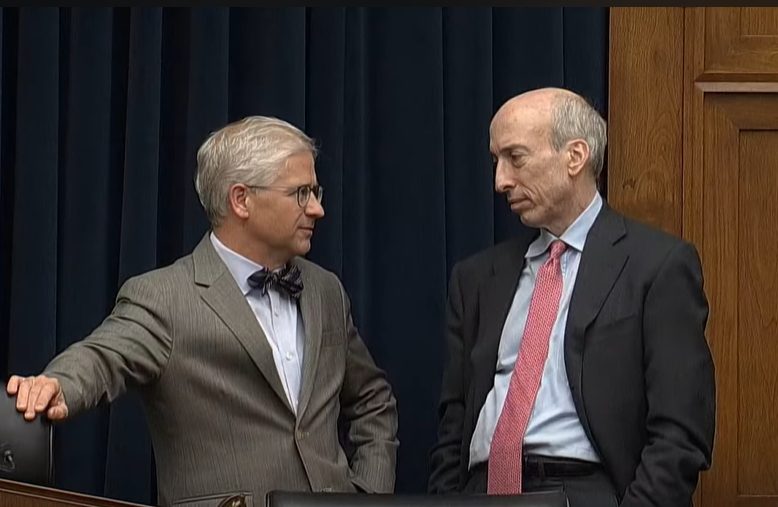

Mr. McHenry, the House Financial Services Committee Chairman, pressed Gensler on his ability to oversee the crypto industry. He argued that the SEC needed help to handle the task and that their enforcement approach could drive businesses and talent out of the US.

Furthermore, the Republican lawmakers accused Gensler of lacking clarity in his approach to regulation, citing his refusal to clarify whether digital assets are subject to securities laws.

The House Financial Services Committee chairman expressed the need for clear road rules for the digital asset ecosystem. He suggested that the entire industry needs guidance from the SEC.

Earlier this month, Gensler expressed his opinion that Bitcoin is a commodity. Following the statement, Garry Gensler was asked the following question by Mr. McHenry:

“Do you think it services the market for an object to be viewed by the security regulators as a security and the commodities regulator as a commodity? Do you think that it provides safety and soundness for the product? Do you think it provides consumer protection? Do you think that it serves the value of innovation?”

When asked whether Ethereum is a security or a commodity, Gensler responded, “It depends on the facts and the laws.” This response was seen as further evidence of a need for more clarity.

“At the same time, you have refused to clarify whether digital assets offered as part of an investment contract are subject to securities laws. And, more importantly, how these firms should comply with those laws…” said Mr. McHenry.

Mr. McHenry pushed Gensler to provide a straightforward answer, asking him whether it serves the market for an object to be viewed by security regulators as security and by commodities regulators as a commodity. He also questioned whether this approach provides safety and soundness for the product and consumer protection. Finally, he asked whether this approach serves the value of innovation.

“Do you think it services the market for an object to be viewed by the security regulators as a security and the commodities regulator as a commodity? Do you think that it provides safety and soundness for the product? Do you think it provides consumer protection? Do you think that it serves the value of innovation?” asked the chairman. After the head of the SEC avoided the question, McHenry stated that his and the company’s uncertainty is “bad” for the industry.

To conclude the conversation, McHenry asked Gensler if he agreed that the marketplace needs more clarity. Gensler responded positively, stating that he believes the law is clear.

The House Financial Services Committee chairman expresses the need for the whole industry the SEC must provide clear rules of the road for the digital asset ecosystem.

In conclusion, the exchange between the two sides highlights the ongoing debate around regulating digital assets and the need for clear guidelines to create a recreation ground for businesses and investors alike. The Republican lawmakers have called for action against Gensler and the SEC for their handling of this critical issue. It remains to be seen whether their calls for action will be heeded.